From AI to Mini-Environments

Indian Battery Industry to Reach USD 18.3 Billion by 2030

Electric vehicles (EVs) are one of the key technologies for reducing CO₂ emissions—and batteries are the key to that. Globally, around 40% of all new cars registered by 2030 will be electric, and more than half by 2035, according to Germany’s Fraunhofer ISI. This drives battery demand: a Porsche Consulting study for the VDMA predicts the global battery market will surge from €20 billion in 2020 to €550 billion by 2030, growing at 40% annually.

In India, EV registrations rose by 45% in 2023/24. According to tech news portal evertiq, the Indian EV market is expected to grow from USD 34.8 billion (2024) to USD 120 billion by 2030. This means India’s EV battery demand will rise from 4 GWh in 2023 to nearly 139 GWh by 2035. This exponential growth can only be met with highly automated manufacturing systems that enable rapid scaling. If successful, analysts at Omdia forecast the Indian battery sector will grow from USD 8.4 billion in 2025 to USD 18.3 billion in 2030.

Automation and Digitalization as Key Levers Amid Skilled Labor Shortages

Rapid expansion of India’s battery industry is creating a shortage of skilled workers, especially in cell manufacturing, quality control, and recycling. A study by the IISD and NITI Aayog identifies automation as a key factor for scaling production. Digital twins and real-time analytics enable flexible product customization for export markets. Most importantly, automation reduces production costs: without it, costs in India would be 17–22% higher than in China or Europe, according to Omdia.

India’s sustainability goals also require modernizing battery production. The country has pledged to reach net-zero emissions by 2070. To support this, the 2021 Production Linked Incentive Scheme for Advanced Chemistry Cells (PLI-ACC) offers up to USD 2.16 billion in subsidies. Companies can receive up to USD 23.9 per kWh if they achieve 60% local value creation within five years and invest at least USD 27 million per GWh. This has significantly boosted investment in automated manufacturing: India’s production capacity is expected to grow from 18 GWh in 2023 to 145 GWh by 2030. Ola Electric, for example, plans to expand its gigafactory in Tamil Nadu to 100 GWh.

Modernization and Collaboration: Keys to Competitiveness

Studies from institutions like Capgemini Research Institute show that battery producers worldwide – not just in India – are often unprepared for the next generation of battery cells. Many facilities are outdated and need fundamental modernization or complete rebuilding. “Technological advances across the battery value chain will reshape the industry and offer high potential for new use cases,” says Michael Müller, Head of Climate Tech & Sustainability at Capgemini Engineering Germany. Digital technologies are becoming increasingly important – from quality control to lifecycle management and recycling. Data-driven systems and smart automation offer huge potential for improving efficiency and sustainability.

Close collaboration among industry, research, and regulators is essential. Only through connected innovation ecosystems can the transition to sustainable, battery-based mobility succeed. Many experts believe more cooperation is needed to compete globally, especially in module and battery pack assembly. In India, partnerships with global players are crucial. They accelerate technology transfer, build expertise, and speed up industrialization. Agratas Energy and Tata Technologies, for example, are co-developing innovative battery solutions with digital production architectures. Amara Raja, a leading battery manufacturer, also relies on strong partnerships and investments in new technologies and markets. Without these synergies, India’s goal of producing 50% of battery cells locally by 2030 would be out of reach.

Digital Solutions Cut Emissions, Waste, and Costs – While Ensuring Quality

Digital solutions will play the most important role in the coming years. A lithium-ion cell factory with 40 GWh annual capacity can save up to USD 31 million per year through digitalization, according to a joint study by Fraunhofer FFB and Accenture. CO₂ emissions could also be reduced by 10%.

Digital quality systems can cut scrap rates by up to 10%. Since materials account for 70% of production costs, this leads to significant savings. Digital optimization also reduces energy use by up to 9.5%, which is the main lever for cutting emissions. Predictive maintenance reduces downtime by over 7%.

The European research project FULL-MAP, launched in spring 2025, uses AI, big data, and autonomous synthesis to accelerate sustainable battery development. It aims to create an interoperable data framework for structured information sharing on battery materials and interfaces, along with flexible design tools, improved analytics, and AI-driven synthesis robots.

Mini-Environments Significantly Reduce Energy Consumption

Another solution is mini-environments: enclosing production equipment to locally control purity, temperature, and humidity. This could replace large, energy-intensive clean and dry rooms, significantly reducing energy use.

A June 2025 study by Fraunhofer ISI highlights the savings potential of mini-environments. While still in the pilot stages, some industrial applications already exist with broader market adoption expected by 2028.

At KIT’s wbk Institute of Production Science in Germany, the AgiloBat project has already implemented agile lithium-ion cell manufacturing using robot-based automation in mini-environments. This allows flexible production of various cell geometries without complex retooling. Special robot cells were developed to deliver filtered air directly to the process, minimizing energy use.

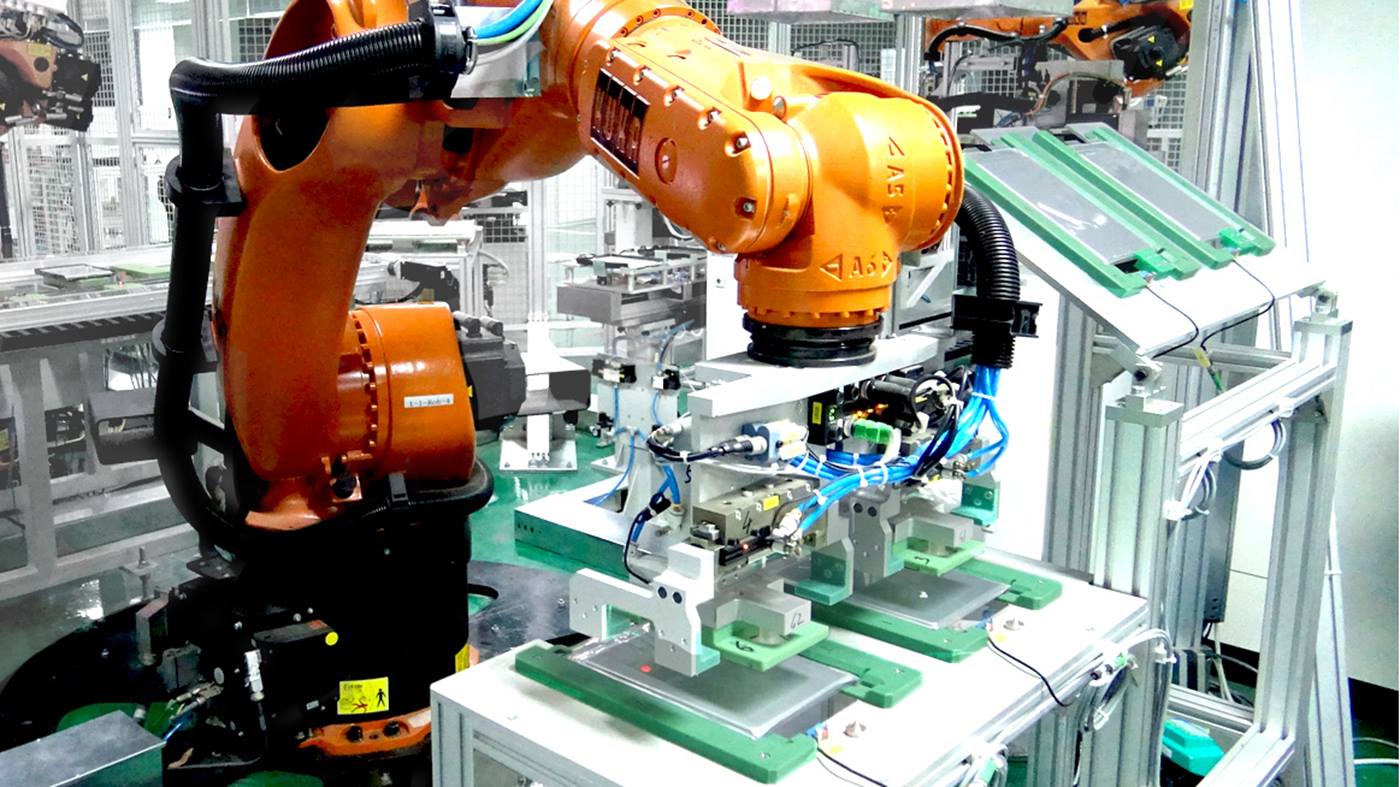

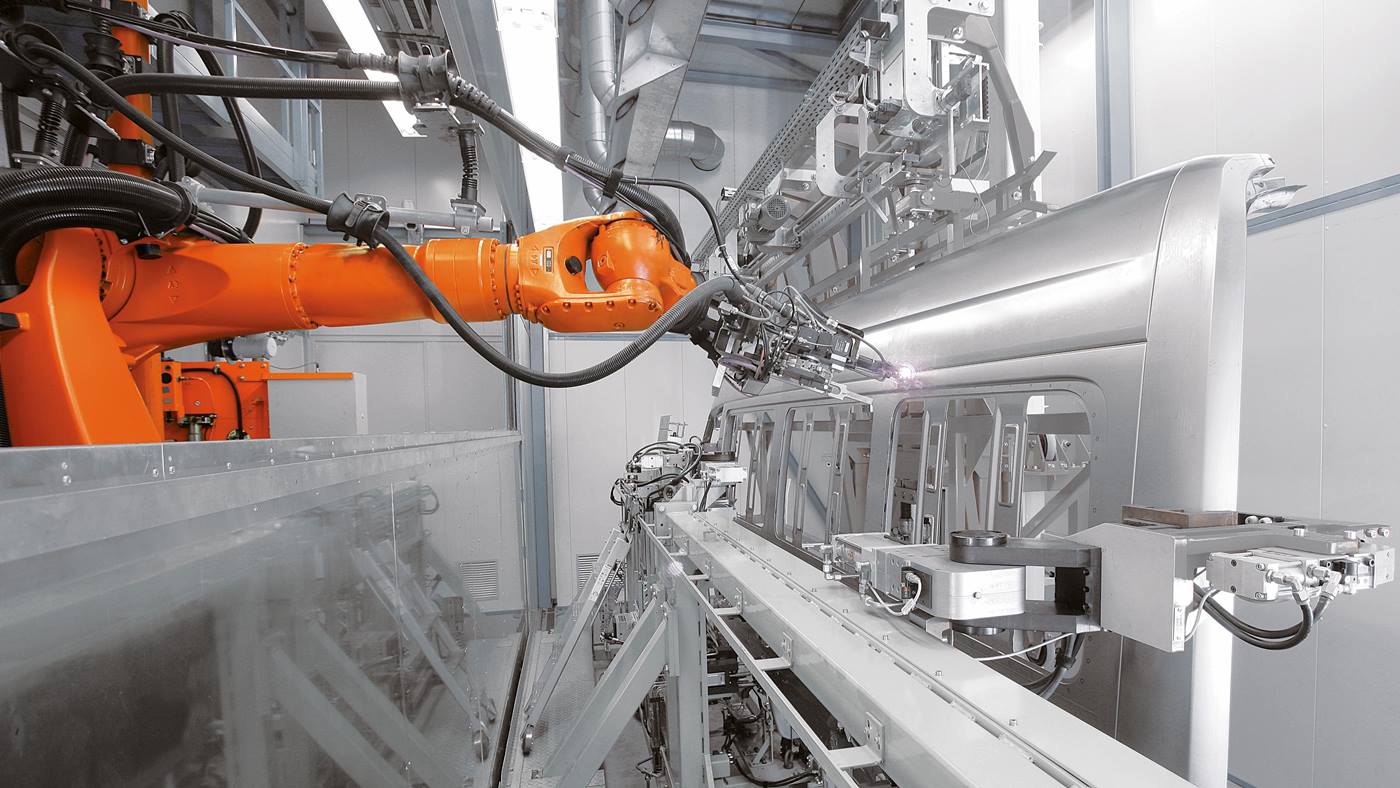

Robots like KR CYBERTECH nano, KR 4 AGILUS, and KR SCARA from KUKA are used in AgiloBat. “Battery cell manufacturers have used KUKA robots in dry rooms for years to reduce contamination and improve quality,” says Thomas Schmidberger, Business Development Manager at KUKA. Dry room conditions pose challenges like increased wear due to low humidity, especially for materials with plasticizers.

“We wanted a highly flexible system with modular production steps,” says AgiloBat’s technical lead Sebastian Henschel. “KUKA robots delivered industrial repeatability and precision with the flexibility of manual production.”

These methods save significant resources. Dry rooms account for 25–40% of gigafactory energy use. Mini-environments drastically cut these operating costs and reduce scrap.

Flexible, Modular Systems for Fast Iteration Cycles

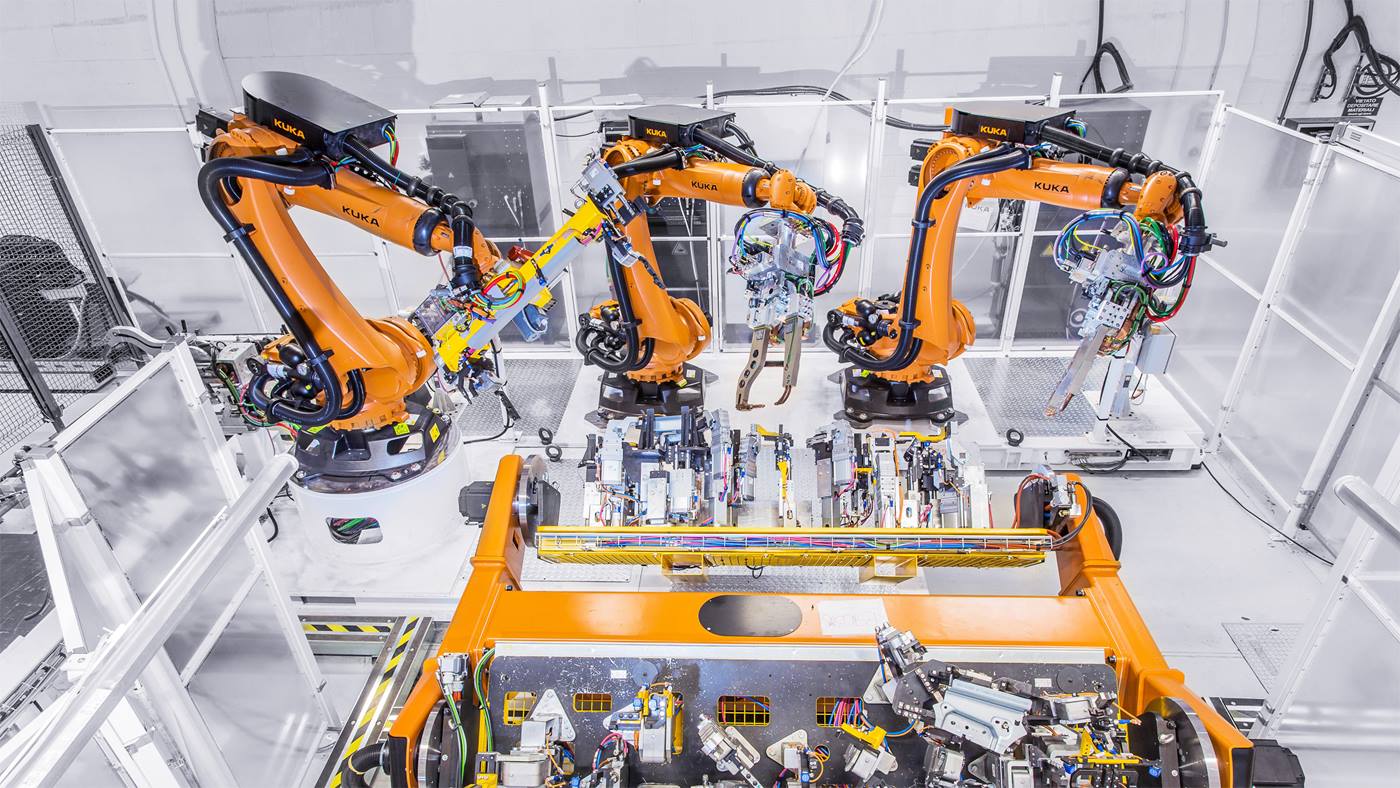

KUKA has spent over a decade optimizing its portfolio for automotive electronics production, with a strong focus on batteries. It collaborates with major battery manufacturers and system integrators.

KUKA Systems, its in-house integrator, recently built a modular battery production facility for MAN Truck & Bus in Nuremberg. The system operates without a fixed line, handles multiple product variants, and adapts easily. Stations operate independently, and battery packs move based on need. Material supply is fully automated using 35 KMP 3000P autonomous mobile robots (AMRs).

KUKA’s technologies offer the flexibility and modularity needed to stay competitive. Battery production cycles are short and dynamic, with changes often occurring during tenders or commissioning. “Without a flexible, modular setup, companies risk costly idle facilities,” says Schmidberger.

Automation Potential in Battery Logistics

Automation is also vital in battery logistics, with major optimization potential. “Battery logistics is a cornerstone of e-mobility,” says Arkadius Schier, head of the InnoLogBat project at Fraunhofer IML. KUKA focuses on AMR solutions for material transport and production flow. “Ease of use and integration are key for our customers,” says Dominik Haas, Head of AMR at KUKA. Standardized hardware/software and open fleet management systems make it easier to automate previously difficult areas.

As battery systems become more varied, logistics must become more flexible. AI can analyze data and optimize workflows, routes, and task distribution – cutting costs significantly.

Flexible Automation for Battery Recycling

With more EVs, battery waste is growing. Recycling is essential, especially as raw materials become scarce. Intelligent automation is the key to sustainable, cost-effective solutions.

Fraunhofer IPA’s DeMoBat project tested industrial battery and motor disassembly using a KR QUANTEC Fraunhofer IPA’s DeMoBat project tested industrial battery and motor disassembly using a

“Automakers pack many components into tight spaces, limiting movement during disassembly,” says Anwar Al Assadi of Fraunhofer IPA. Challenges include cable placement and adhesive bonds. But IPA has developed automation solutions now being industrialized. “Flexible systems are essential,” says Al Assadi, “especially since battery designs change every six months.”

Flexibility as a Competitive Advantage

Whether in assembly, logistics, or recycling, Indian battery manufacturers need integrated, flexible, and modular automation to meet growing demands for volume, quality, and sustainability. Smart technologies and adaptable setups ensure long-term success in a dynamic market and provide the flexibility needed for future innovation.

Manual methods can’t deliver the required speed or consistency. Therefore, automation isn’t just a cost-cutting tool – the backbone of a competitive, scalable, and resilient domestic battery industry. Only with automation can India compete on equal footing with global leaders in efficiency, quality, and performance.